Life Insurance in and around Dayton

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

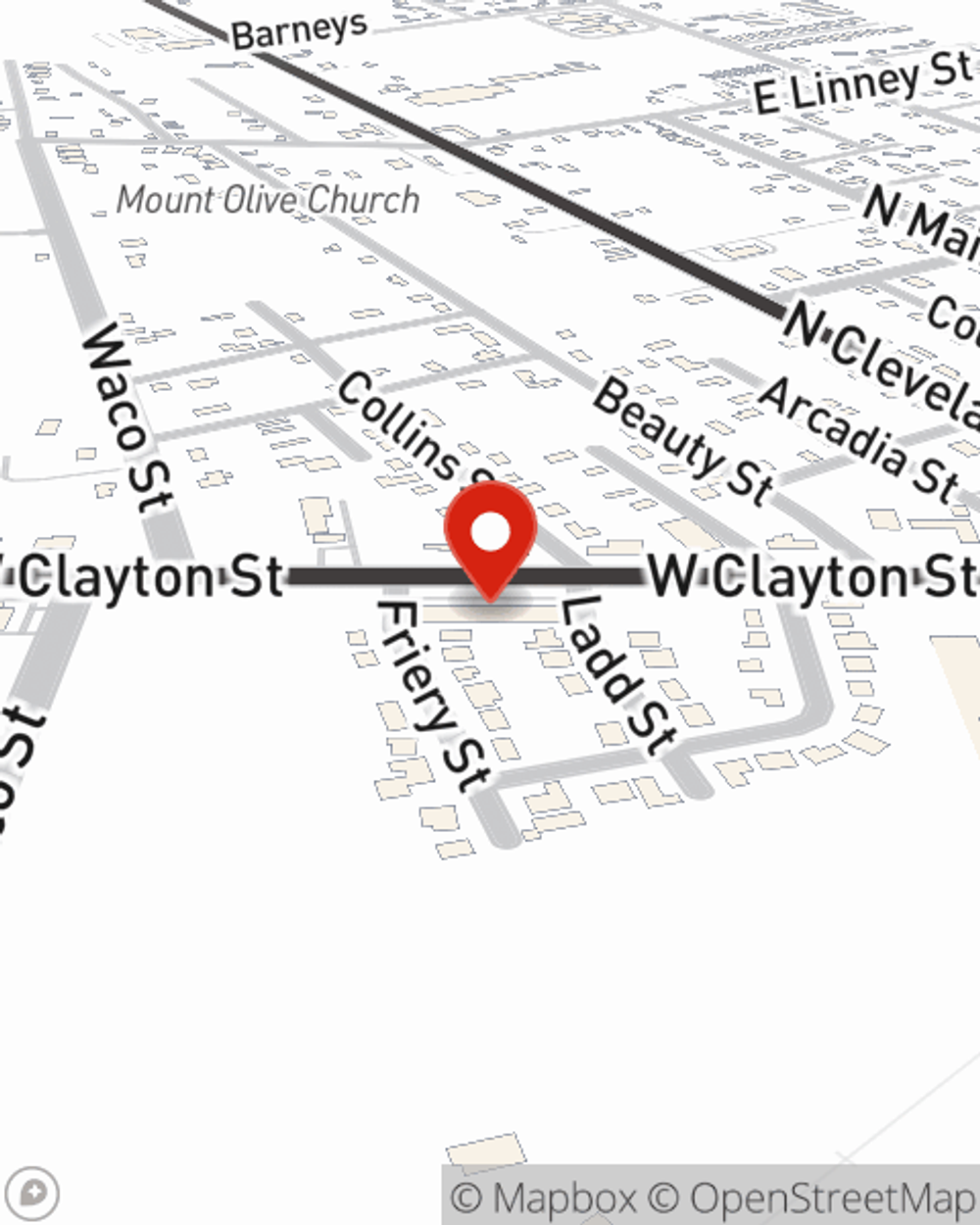

- Dayton

- Liberty County

- Liberty

- Mont Belvieu

- Cleveland

- Huffman

- Chambers County

It's Never Too Soon For Life Insurance

When it comes to high-quality life insurance, you have plenty of choices. Evaluating riders, coverage options, providers… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Jordan Thibodeaux is a person who is dedicated to helping you set you up with a plan for your specific situation. You’ll have a no-nonsense experience to get budget-friendly coverage for all your life insurance needs.

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Dayton Chooses Life Insurance From State Farm

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Jordan Thibodeaux is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

To discover your Life insurance policy options, reach out to Jordan Thibodeaux's office today!

Have More Questions About Life Insurance?

Call Jordan at (936) 258-5858 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Jordan Thibodeaux

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.